Medicare

Senior Insurance Professionals, LLC

Medicare Insurance Plans in Winston‑Salem

Personalized Guidance You Can Trust

Navigating Medicare can feel overwhelming—but with Senior Insurance Professionals, LLC by your side, you don’t have to do it alone. Based in Winston‑Salem, we provide clear, compassionate guidance through every part of the Medicare process. Whether you're approaching eligibility or reviewing your current plan, we’ll help you make informed decisions that protect your health and finances.

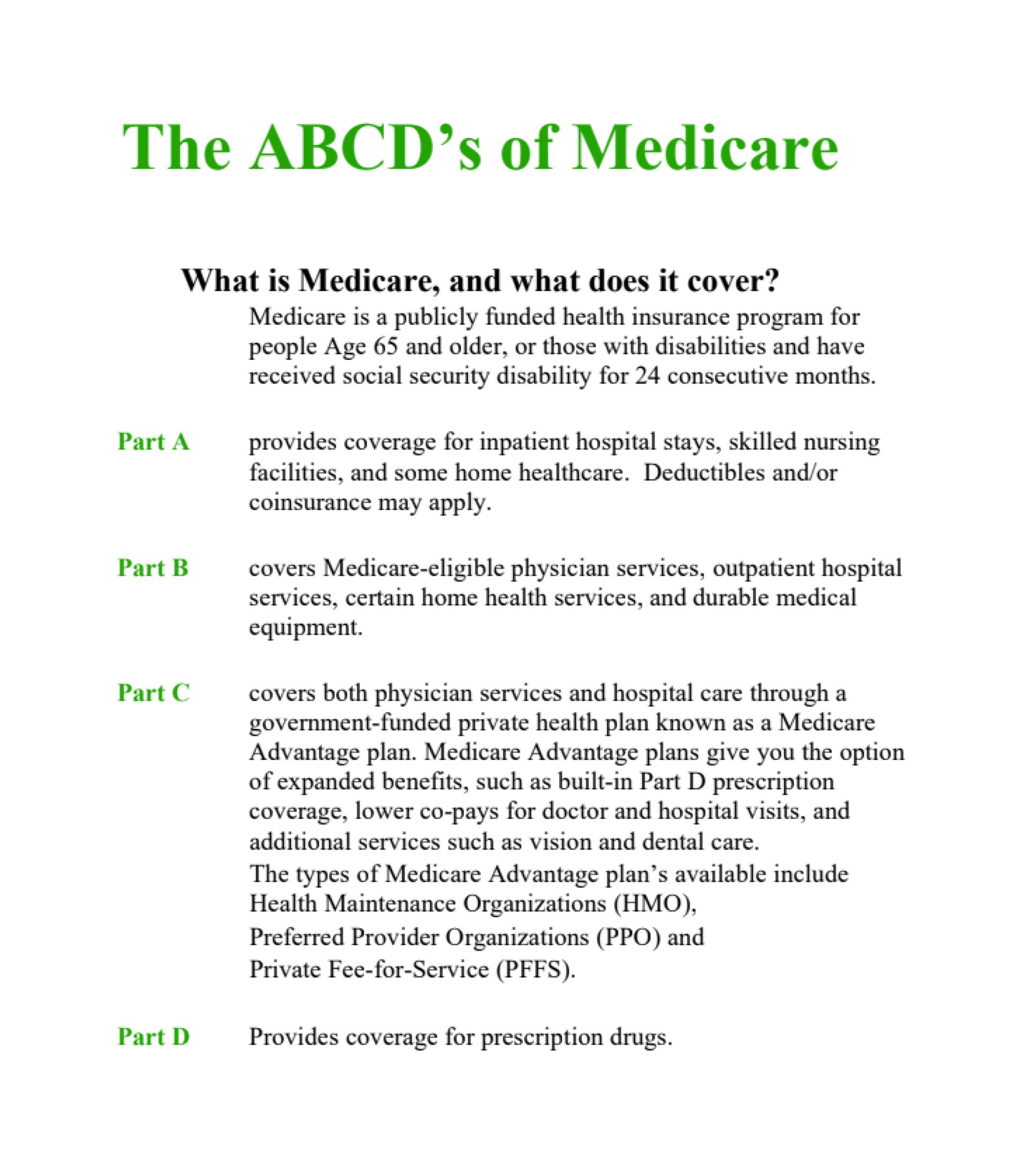

Understanding the Basics of Medicare

Medicare is a federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities. It includes different parts that cover hospital care, medical services, and prescription drugs.

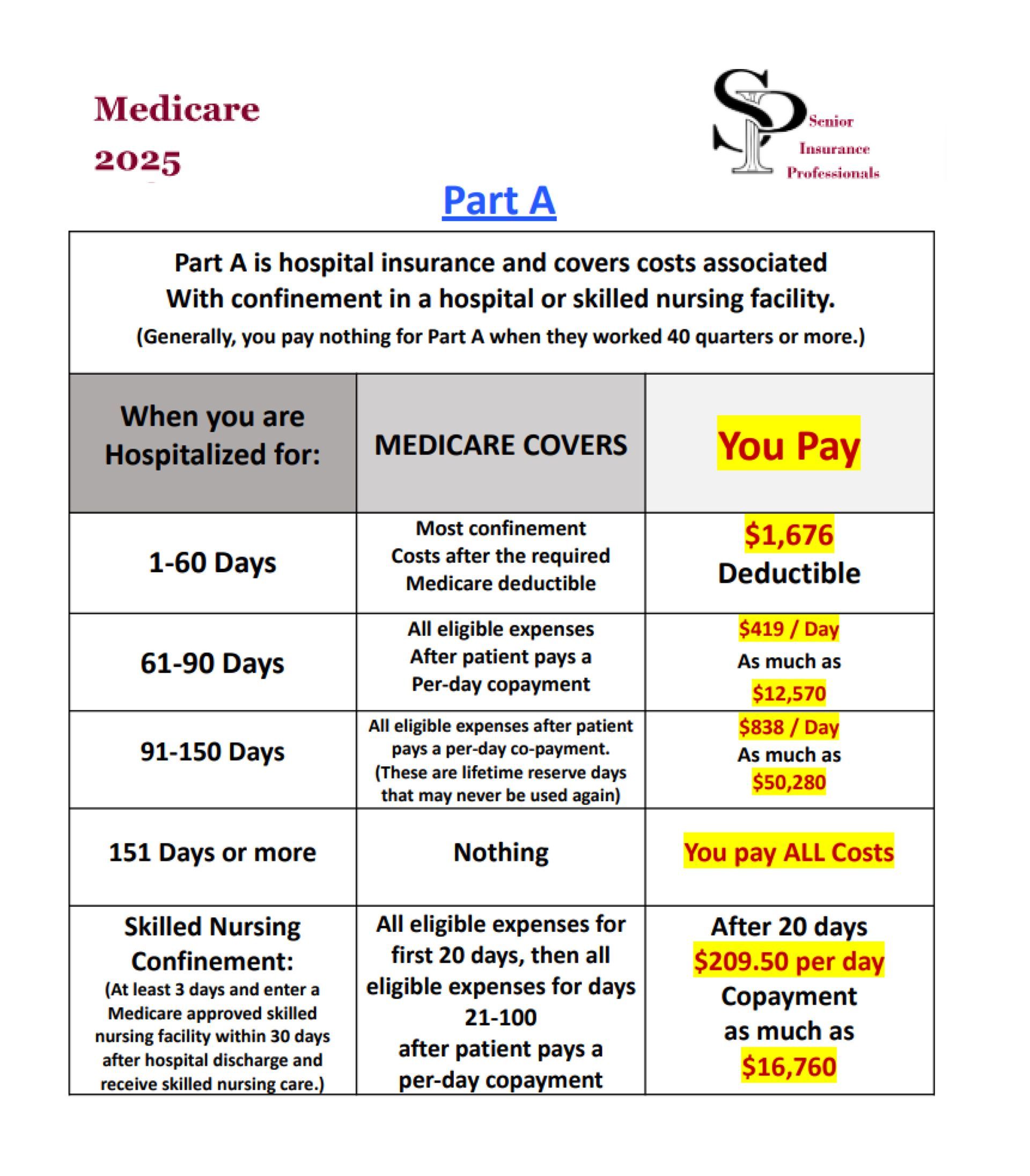

Medicare Part A – Hospital Insurance

Part A covers inpatient hospital care, skilled nursing facilities, hospice care, and some home health services. Most people do not pay a premium for Part A.

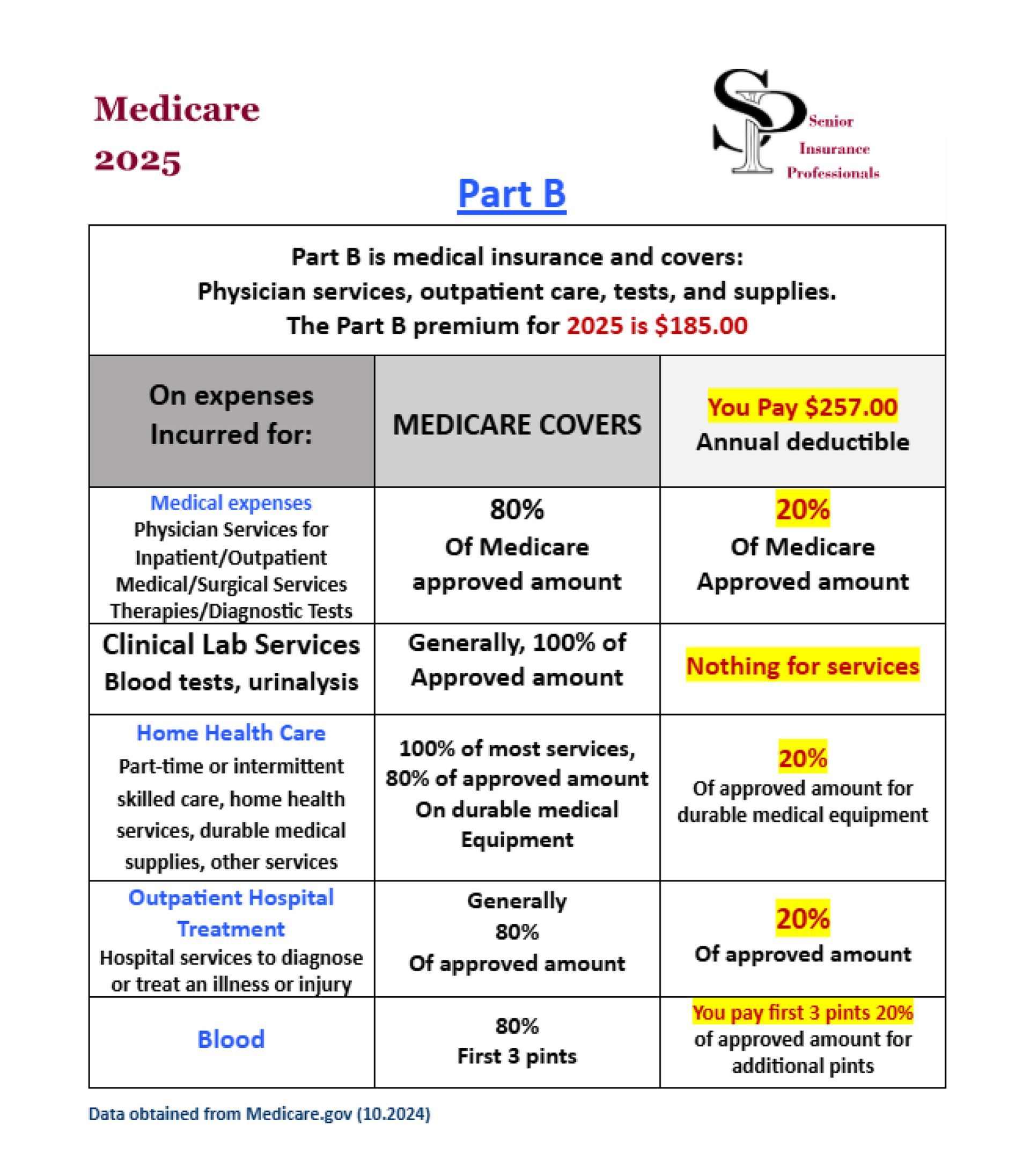

Medicare Part B – Medical Insurance

Part B covers doctor visits, outpatient services, preventive care, and medical equipment. It requires a monthly premium, which can vary based on income.

Medicare Part C – Medicare Advantage

Offered by private insurers, Medicare Advantage (Part C) combines Parts A and B, and often includes prescription drug coverage, dental, vision, and wellness benefits. These plans vary by county and provider network.

Medicare Part D – Prescription Drug Coverage

Part D helps cover the cost of prescription medications. Plans differ by formulary (drug list), pharmacy network, and monthly premium.

Medicare Supplement (Medigap)

Medigap plans are designed to cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. These plans offer predictable costs and broad provider access.

How We Help You Navigate Medicare

At Senior Insurance Professionals, LLC, we simplify the Medicare process by offering:

One-on-One Consultations

We meet with you personally—by phone, video, or in-office—to review your current health needs, prescription usage, and provider preferences.

Plan Comparisons

We work with multiple insurance carriers to help you compare Medicare Advantage, Medigap, and Part D plans available in your ZIP code. We explain the fine print, from premiums and copays to network restrictions and benefit extras.

Enrollment Assistance

We walk you through the application process during Initial Enrollment, Annual Enrollment (Oct 15–Dec 7), or Special Enrollment periods. We ensure forms are filed correctly and deadlines are met.

Ongoing Support

Already enrolled in Medicare? We provide annual reviews to check if your current plan is still the best fit—and assist with changes or re-enrollment when needed.

Medicare Isn’t One-Size-Fits-All

The right Medicare plan depends on your:

- Health conditions and medications

- Preferred doctors and hospitals

- Budget for premiums and out-of-pocket costs

- Travel needs or dual residency

- Comfort level with managed care (HMOs vs PPOs)

Our job is to ask the right questions, explain your choices clearly, and recommend a plan that aligns with your life.

Frequently Asked Questions

When should I enroll in Medicare?

You’re eligible at age 65, with your Initial Enrollment Period beginning 3 months before your 65th birthday and ending 3 months after. Missing deadlines can result in penalties.

What if I’m still working at 65?

You may delay Part B and Part D if you have credible employer coverage. We’ll help assess your situation and avoid unnecessary penalties.

Can I switch plans later?

Yes. Each year during the Annual Enrollment Period (Oct 15–Dec 7), you can switch between Medicare Advantage and Original Medicare, change drug plans, or review better options.

What’s the difference between Advantage and Supplement plans?

Advantage plans are all-in-one alternatives managed by private insurers; they may have lower premiums but higher copays and network limits. Supplement plans work with Original Medicare to reduce out-of-pocket costs and allow broader provider access.

Get Trusted Medicare Help in Winston‑Salem

Choosing a Medicare plan doesn’t have to be stressful. With Senior Insurance Professionals, LLC, you gain a local advisor who’s committed to helping you make confident, informed choices.